You’ve probably seen or heard ads urging you to donate your car to charity. “Make a difference and receive tax savings,” one organization states. But donating a vehicle may not result in a big tax deduction — or any deduction at all. Trade in, sell or donate? Let’s say you’re buying a new car and […]

Life insurance has long provided a source of liquidity to pay estate taxes and other expenses. But, with the estate tax exemption currently set at an inflation-adjusted $10 million ($11.40 million for 2019), estate taxes are no longer a concern for many families. Nonetheless, life insurance offers many benefits for nontaxable estates. If you own life insurance […]

When you retire, you may consider moving to another state — say, for the weather or to be closer to your loved ones. Don’t forget to factor state and local taxes into the equation. Establishing residency for state tax purposes may be more complicated than it initially appears to be. Identify all applicable taxes It […]

Companies tend to spend considerable time and resources training and upskilling their sales staff on how to handle existing customers. And this is, no doubt, a critical task. But don’t overlook the vast pool of individuals or entities that want to buy from you but just don’t know it yet. We’re talking about prospects. Identifying […]

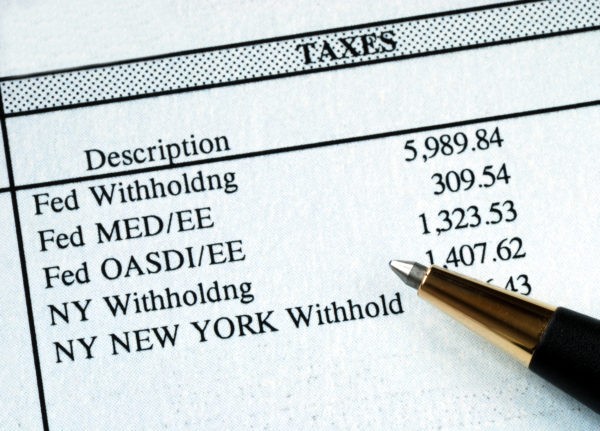

Due to the massive changes in the Tax Cuts and Jobs Act (TCJA), the 2019 filing season resulted in surprises. Some filers who have gotten a refund in past years wound up owing money. The IRS reports that the number of refunds paid this year is down from last year — and the average refund […]

Spring and summer are the optimum seasons for selling a home. And interest rates are currently attractive, so buyers may be out in full force in your area. Freddie Mac reports that the average 30-year fixed mortgage rate was 4.14% during the week of May 2, 2019, while the 15-year mortgage rate was 3.6%. This […]

The gift and estate tax exemption is higher than it’s ever been, thanks to the Tax Cuts and Jobs Act (TCJA), which temporarily doubled the exemption to an inflation-adjusted $10 million ($20 million for married couples who design their estate plans properly). This year, the exemption amount is $11.4 million ($22.8 million for married couples). If you’re married and […]

It’s that time of year when many people who filed their tax returns in April are checking their mail or bank accounts to see if their refunds have landed. According to the IRS, most refunds are issued in less than 21 calendar days. However, it may take longer — and in rare cases, refunds might […]

While the number of plug-in electric vehicles (EVs) is still small compared with other cars on the road, it’s growing — especially in certain parts of the country. If you’re interested in purchasing an electric or hybrid vehicle, you may be eligible for a federal income tax credit of up to $7,500. (Depending on where […]

The pace of health care cost inflation has remained moderate over the past year or so, and employers are trying to keep it that way. In response, many businesses aren’t seeking immediate cost-cutting measures or asking employees to shoulder more of the burden. Rather, they’re looking to “future-focused” health care plan features to encourage healthful […]

Miller Kaplan Arase LLP, a top-100 certified public accounting firm, recently unveiled a major rebrand. This all-encompassing refresh includes branding the firm as Miller Kaplan, a new logo, and a complete redesign of the firm’s website. In recent years, Miller Kaplan has strategically built its staff, capabilities, and technology to better drive the success of […]

Once your 2018 tax return has been successfully filed with the IRS, you may still have some questions. Here are brief answers to three questions that we’re frequently asked at this time of year. Question #1: What tax records can I throw away now? At a minimum, keep tax records related to your return for […]