By Nicholas Sanchez, J.D., LL.M. Taxation; and Kaveh Imandoust, J.D., M.B.T., CPA

Earlier this month the Paycheck Protection Program Flexibility Act of 2020 (H.R. 7010, PPPFA) was signed into law. If you’re not already familiar, the Paycheck Protection Program (PPP) is a provision included in the CARES Act that provides forgivable loans to small businesses to pay their employees during the COVID-19 pandemic. (See also: COVID 3.5 Relief Package and Important Clarifications Regarding the PPP) Now, the PPPFA provides more flexibility for participants in the PPP program, including allowing those participants to defer the payment of payroll taxes that the CARES Act prevented them from deferring.

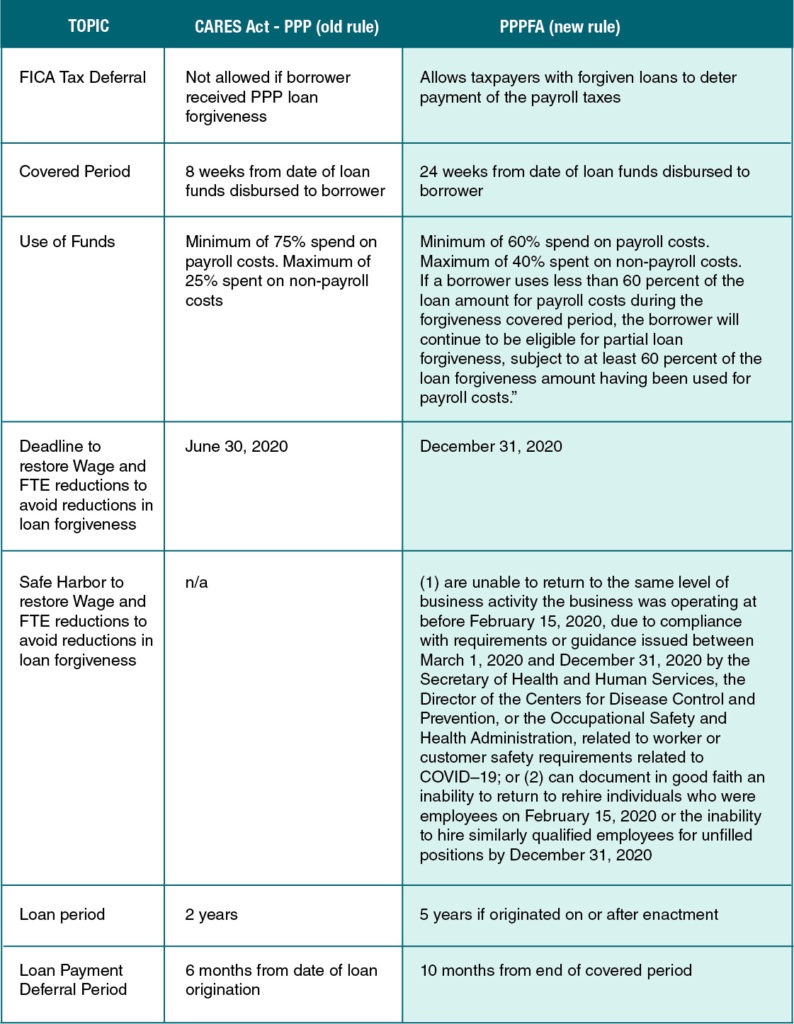

Below, we break out the key changes that come with the PPPFA.

____________________________________

We highly recommend you confer with your Miller Kaplan advisor to understand your specific situation and how this may impact you.