by Alex Chernyak, CPA and Catalina Kirby, CPA

Earlier this year, Office of Labor-Management Standards (OLMS) issued a final rule on a Form T-1 Trust Annual Report that requires annual reporting by certain Form LM-2 filing labor organizations on financial information pertinent to “trusts in which a labor organization is interested.”

In general Form T-1 requires itemization of certain revenue and expense transactions over $10,000 and additional disclosures for disbursements made to officers, trustees, and employees of the trust.

Who must file:

Every labor organization subject to the Form LM-2 filing requirements, with total annual receipts of $250,000 or more, must file Form T-1 each year for each trust in which it is “interested,” if the following conditions exist:

The trust is a trust or other fund or organization:

- that was created or established by a labor organization or a labor organization appoints or selects a member to the trust’s governing board, AND

- the trust has as a primary purpose to provide benefits to the members of the labor organization or their beneficiaries.

AND if one of the following two conditions is met:

- the labor organization alone, or in combination with other labor organizations, either appoints or selects a majority of the members of the trust’s governing board; OR

- contributes greater than 50% of the trust’s receipts during the one-year reporting period.

Any employer contributions made pursuant to a collective bargaining agreement shall be considered the labor organization’s contributions.

When more than one Form LM-2 filing labor organization jointly appoints or selects a majority of the members of the trust’s governing board or jointly contributes greater than 50% of the trust’s receipts during the one-year reporting period, only one organization must file a Form T-1 and requires the following:

- the volunteer, filing labor organization must list all the labor organizations for which it is filing the Form T-1, and

- the non-filing labor organization(s) must note in Additional Information of their Form LM-2 that another labor organization is filing the Form T-1 on its behalf, along with the name of that labor organization and the name of the trust.

A parent labor organization (i.e., the national/international or intermediate labor organization) may file the Form T-1 report for covered trusts in which it and its affiliates jointly meet the above financial domination or managerial control test. The affiliates must continue to identify the trusts in their Form LM-2 Labor Organization Annual Report, and include a statement that the parent labor organization is filing a Form T-1 report for the trust.

Examples of entities that are included in the definition of a trust which a labor organization is interested include, but are not limited to, a multi-union building corporation, redevelopment corporation, educational institute, apprenticeship and training plan.

Abbreviated Form T-1

An abbreviated Form T-1 may be filed for any covered trust or trust fund for which an independent audit has been conducted, in accordance with specific standards described in the Form T-1 instructions.

Exemptions:

No Form T-1 should be filed for any trusts that:

- Meets the statutory definition of a labor organization and already files a Form LM-2, LM-3, or LM-4

- Is an entity that is expressly exempted from reporting in the LMRDA (i.e., state or local central bodies of labor federations)

- Is a subsidiary organization, as defined in the Form LM-2 instructions

- Is a PAC that files publicly available reports with a Federal or state agency

- Is an employee benefit plan covered by ERISA and filed an annual report with EBSA (i.e., pension and health plans that file Form 5500)

- Is a federal employee health benefit plans subject to the provisions of the FEHBA

- Is a for-profit commercial bank established or operating pursuant to the Bank Holding Act

- Constitutes a credit union subject to the Federal Credit Union Act

When to file

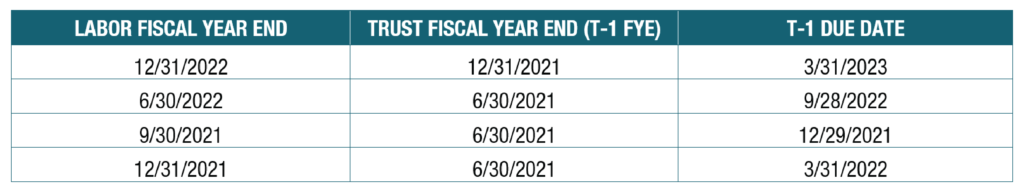

The Form T-1 requirements apply to a labor organization whose fiscal year and the fiscal year of its trust begin on or after July 1, 2020. Form T-1 must be filed within 90 days of the end of the labor organization’s fiscal year. The Form T-1 shall cover the trust’s most recently completed fiscal year ending 90 days or more before the union’s fiscal year end.

The following are examples of filing dates based on the labor organization and trust fiscal year ends:

Form T-1 must be filed electronically to Department of Labor via the OLMS Electronic Forms System (EFS) available on the OLMS website at: http://www.dol.gov/olms.

If you have any questions about Form T-1 or need assistance with filing, please contact us.

____________________________________

We highly recommend you confer with your Miller Kaplan advisor to understand your specific situation and how this may impact you.