By Kaveh Imandoust, J.D., M.B.T., CPA; and Nicholas Sanchez, J.D., LL.M. Taxation

Small and medium-sized businesses (SMBs) are integral to the U.S. economy and create jobs for a large share of the U.S. workforce; however, the spread of COVID-19 has substantially disrupted economic activity in many sectors of the economy – especially for SMBs. The availability of credit has been limited for these businesses – at a time when the economic disruptions have significantly increased the need for those companies to obtain financing.

The CARES Act helps increase liquidity in the markets with the establishment of the Economic Stabilization Fund – which was renamed, by the Federal Reserve, the Main Street Lending Program.

The Main Street program is designed to support lending to SMBs that were in sound financial condition prior to the onset of the COVID-19 pandemic. Unlike with a PPP (Paycheck Protection Program) loan, recipients of a Main Street loan can use the funds for any expense, but the catch is that Main Street loans are full-recourse loans and are not forgivable.

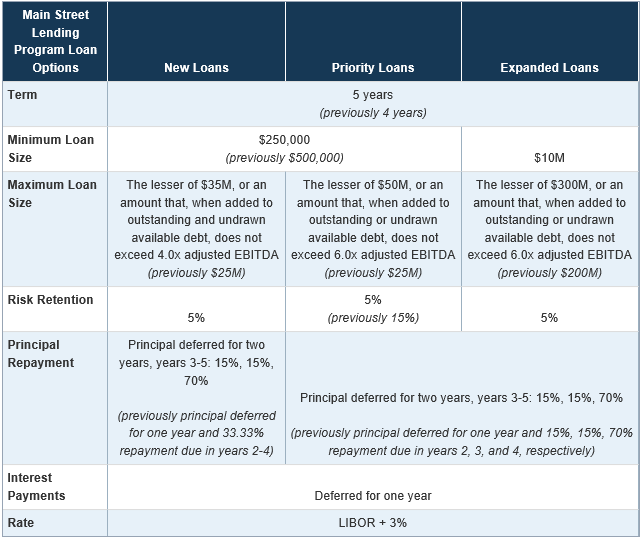

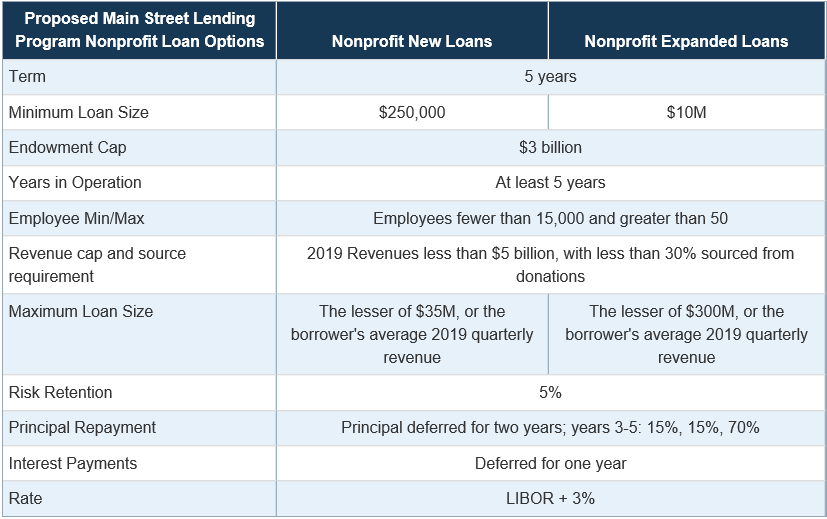

The Program will operate through three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), and the Main Street Expanded Loan Facility (MSELF). In addition, they have created two new facilities: Proposed Nonprofit Organization New Loan Facility (NONLF) and Proposed Nonprofit Organization Expanded Loan Facility (NOELF).

Below is a summary of some of the key terms and conditions of the Main Street program.

Note: Materials terms and conditions are revised often and we will update this chart as those changes are announced.

Loan Forgiveness:

None

Coronavirus Need:

Borrowers must certify that they are unable to secure adequate credit accommodations from other banking institutions.

Borrowers must make commercially reasonable efforts to maintain their payroll and retain their employees during the term of the loan.

Eligible Lender:

An Eligible Lender is a U.S. federally insured depository institution (including a bank, savings association, or credit union), a U.S. branch or agency of a foreign bank, a U.S. bank holding company, a U.S. savings and loan holding company, a U.S. intermediate holding company of a foreign banking organization, or a U.S. subsidiary of any of the foregoing.

Eligible For-Profit Borrower:

1- Was established prior to March 13, 2020

1a- An “Eligible For-Profit Borrower” is an entity that is organized for profit as a partnership; a limited liability company; a corporation; an association; a trust; a cooperative; a joint venture with no more than 49 percent participation by foreign business entities; or a tribal business concern. Other organizations may be considered for inclusion as a Business under the Facility at the discretion of the Federal Reserve.

1b- Note: As of June 26, 2020, the Federal Reserve now has two Proposed Non-Profit Loan Facilities. The Proposed Nonprofit Organization New Loan Facility (NONLF) and Proposed Nonprofit Organization Expanded Loan Facility (NOELF). Each nonprofit must be a IRC § 501(c)(3) or 501(c)(9) tax-exempt organization. Please note these are proposed terms subject to change.

2- is not an Ineligible Business

2a- For purposes of the Facility, an “Ineligible Business” would be activities such as passive real estate entities, companies engaged primarily in lending or companies engaged in illegal activities.

3- meets at least one of the following two conditions: (i) has 15,000 employees or fewer, or (ii) had 2019 annual revenues of $5 billion or less]

3a- For purposes nonprofits, a minimum of 50 employees and a maximum of 15,000. It further requires that the nonprofit has an endowment of $3 billion or less and additional financial limits on ability to repay the debt, liquidity and performance metrics.

4- is created or organized in the United States or under the laws of the United States with significant operations in and a majority of its employees based in the United States

5- does not also participate in the MSPLF, the MSELF, or the Primary Market Corporate Credit Facility; and

6- not received specific support via the Coronavirus Economic Stabilization Act of 2020 (Subtitle A of Title IV of the CARES Act). This includes items of support such as loan guarantees to passenger air carriers, air cargo carriers, business important to maintaining national security, etc.

6a- For the avoidance of doubt, Businesses that have received PPP loans are permitted to borrow under the Facility, provided that they are Eligible Borrowers.

Caution: Unlike the Paycheck Protection Program, the Main Street Lending Program is not an SBA program and is not run by the SBA. That said, particular SBA rules apply; for example, the SBA’s affiliation rules apply as it related to a borrower’s number of employees and revenues. Also, the above criteria are only the basic eligibility requirements; there are additional certifications, conditions, and covenants the borrower is expected to meet.

Interest Rate:

Adjustable rate of LIBOR (1 or 3 month) + 300 basis points

Loan Term:

- 5 years

- Two year deferral on principal payments

- One year deferral on interest payments with unpaid interest capitalized

- Principal amortized at

- 15% at end of third year

- 15% at end of fourth year

- 70% balloon at end of fifth year

Prepayment Penalty:

None

Minimum Loan Amount:

- MSLF: $250,000

- MSPLF: $250,000

- MSELF: $10,000,000

- NONLF: $250,000

- NOELF: $10,000,000

Maximum Loan Amount:

- MSLF:

- The lesser of $35M, or an amount that, when added to outstanding and undrawn available debt, does not exceed 4.0x adjusted earnings before interest expense, taxes, depreciation and amortization (“EBITDA”)

- MSPLF:

- The lesser of $50M, or an amount that, when added to outstanding or undrawn available debt, does not exceed 6.0x adjusted EBITDA

- MSELF:

- The lesser of $300M, or an amount that, when added to outstanding or undrawn available debt, does not exceed 6.0x adjusted EBITDA

- NONLF:

- The lesser of $35,000,000 or borrower’s average 2019 quarterly revenue

- NOELF:

- The lesser of $300,000,000 or the borrower’s average 2019 quarterly revenue

Use of Proceeds:

Unlike the PPP which expressly defines how funds may be used, the Main Street loans limit how funds may be expended. Please see Restrictions and Conditions below.

Restrictions and Conditions:

When the loan is repaid, the borrower must commit for the next twelve months that it will not:

- Repurchase exchanged-traded equities of the borrower or its parent company unless required due to pre-03/27/20 contractual obligations.

- Issue Dividends, stock or capital distributions (distributions made by flow-through entity is allowed to the extent reasonably required to cover its owners’ tax obligations from the entity’s earnings).

- Exceed compensation limit rules. Different compensation rules apply to officers’ earnings over $425,000 and $3,000,000 annual.

PLEASE REFER TO THESE CHARTS FOR EASY REFERENCE OF MANY OF THE KEY TERMS OF THE LOAN.

____________________________________

We highly recommend you confer with your Miller Kaplan advisor to understand your specific situation and how this may impact you.