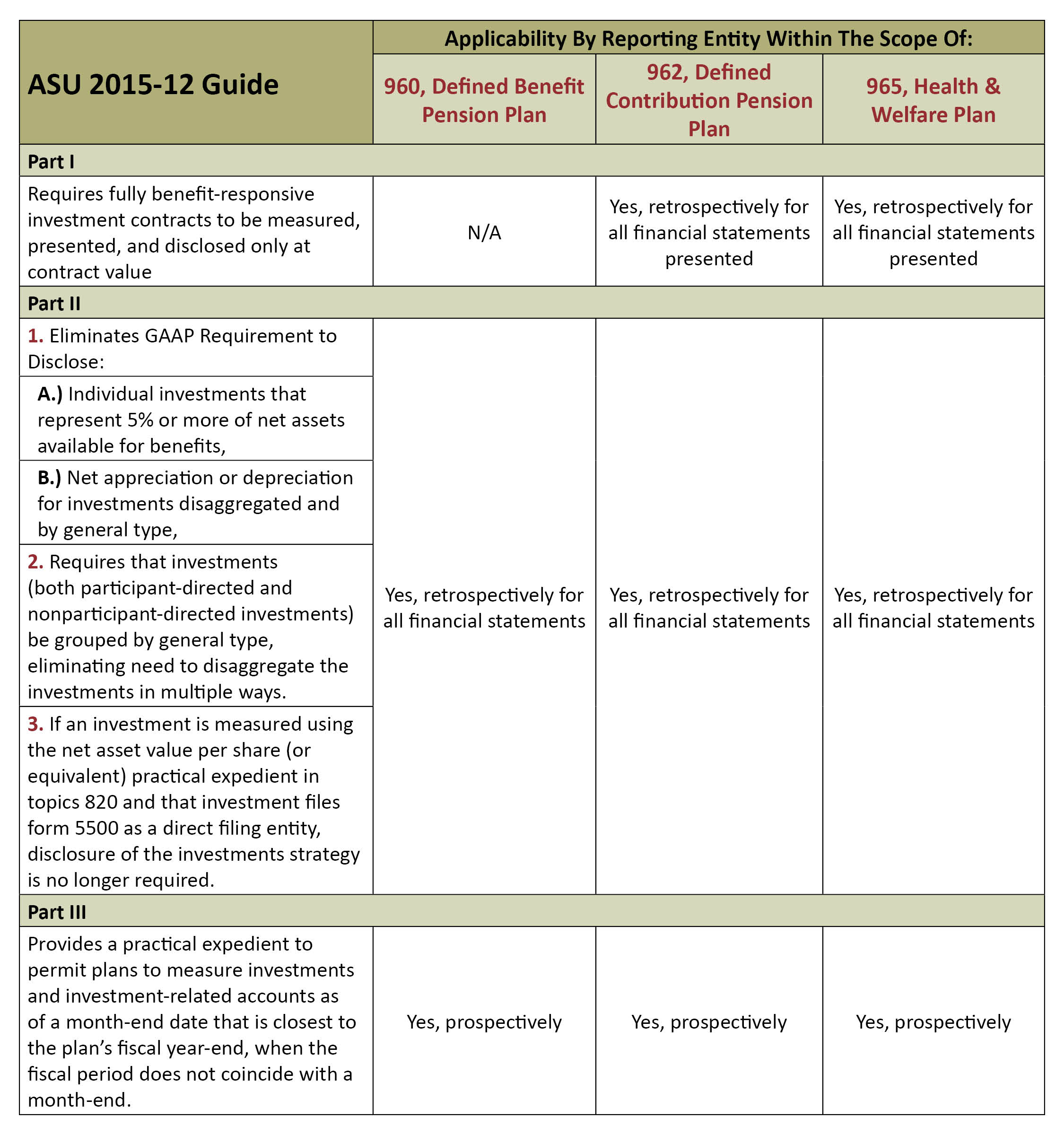

The Financial Accounting Standards Board (FASB) recently issued ASU 2015-12 Plan Accounting: Topic 960, Defined Benefit Pension Plans; Topic 962, Defined Contribution Pension Plans; Topic 965, Health and Welfare Benefit Plans. The guidance consists of three parts:

Part I designates contract value as the only required measure for fully benefit-responsive investment contracts. An adjustment to reconcile contract value to fair value when these measures differ is no longer required. A plan will continue to provide disclosures that help users understand the nature and risks of fully benefit-responsive investment contracts.

Part II eliminates the requirement to disclose individual investments that represent 5% or more of net assets available for benefits and the requirement to disclose net appreciation (depreciation) in fair value of investments by general type of investment. In addition, it provides for employee benefit plan investments to be grouped and presented by general type and eliminates the requirement to disaggregate investments in multiple ways. Further, disclosure of an investment’s strategy will no longer be required when measured using net asset value per share (or its equivalent) if such investment files Form 5500 as a direct filing entity.

Part III allows a plan with a fiscal year-end that does not coincide with a month-end to measure investments as of the month-end date that is closest to the plan’s fiscal year-end. If a plan applies this practical expedient and a contribution, distribution, and/or significant event occurs between the alternative measurement date and the plan’s fiscal year-end, the plan should disclose such amount(s).

ASU 2015-12 is effective for fiscal years beginning after December 15, 2015. Earlier application is permitted. Amendments in Parts I & II should be applied retrospectively for all financial statements presented; Part III is to be applied prospectively.

____________________________________

We highly recommend you confer with your Miller Kaplan advisor to understand your specific situation and how this impacts you.